Crypto Investing: Risk vs Reward in the New Digital Economy

The growing interest in cryptocurrency as an investment vehicle has sparked intense debate in the financial world. As digital assets become increasingly mainstream, potential investors are asking: “Is crypto a good investment?” The answer lies in understanding the risk vs. reward paradigm that defines this emerging market.

The blockchain technology underlying cryptocurrency has revolutionized the way we think about investment and market dynamics. With the 2024 regulatory developments, including the SEC’s approval of spot Bitcoin ETFs, the landscape is evolving rapidly.

This article aims to provide a balanced view of the potential benefits and risks associated with cryptocurrency investing, helping readers make informed decisions. By exploring market evolution, potential benefits, and investment strategies, we will examine the place of digital assets in a diversified portfolio.

The Evolution of Cryptocurrency as an Investment

From its humble beginnings as a peer-to-peer electronic cash system, cryptocurrency has evolved into a recognized investment asset class. The journey began with Bitcoin‘s introduction in 2009, marking the start of a new era in the financial world. As blockchain technology advanced, it paved the way for the growth of cryptocurrency as a viable investment option.

From Bitcoin’s Origins to Today’s Digital Economy

The digital economy has created new opportunities for blockchain-based assets, transforming cryptocurrency from a niche interest among tech enthusiasts to a mainstream financial instrument. Institutional investors are now attracted to this emerging market, driven by the potential for significant returns on investment. As a result, cryptocurrencies have become a widely discussed topic in financial circles.

The 2024 Regulatory Landscape

In 2024, the SEC approved the trading of spot Bitcoin and Ether exchange-traded funds (ETFs), a significant regulatory development that has legitimized cryptocurrencies as investment vehicles. This move represents a turning point for cryptocurrency integration into traditional finance, despite the SEC’s historically cautious approach to cryptocurrency and related investments. The impact of this decision is still being analyzed, but it is clear that it has brought more clarity to the market, leveraging advancements in technology.

| Year | Event | Impact on Cryptocurrency |

|---|---|---|

| 2009 | Bitcoin’s Introduction | Marked the beginning of cryptocurrency as an investment asset class |

| 2024 | SEC Approval of Spot Bitcoin and Ether ETFs | Legitimized cryptocurrencies as investment vehicles, increasing their accessibility to traditional investors |

Understanding the Cryptocurrency Market

Understanding the cryptocurrency market is crucial for navigating the complex world of digital assets. The market’s structure, including exchanges, market capitalization, and trading volumes, provides valuable insights into its dynamics.

Major Cryptocurrencies and Their Differences

The cryptocurrency landscape is dominated by Bitcoin, Ethereum, and various altcoins, each serving different purposes and leveraging unique technologies. For instance, Ethereum’s smart contracts enable the creation of decentralized applications, expanding the utility of blockchain technology beyond simple transactions.

How Blockchain Technology Drives Value

Blockchain technology creates trust and security through decentralization and cryptographic verification, making it a cornerstone of the market value for cryptocurrencies. The immutable nature of public ledgers contributes to the value proposition of digital assets, while the technology enables secure, transparent transactions.

For more information on investing in cryptocurrency, visit this resource to explore the risks and rewards in detail.

Is Crypto a Good Investment? Analyzing the Fundamentals

The question of whether crypto is a good investment depends on various factors, including individual financial goals and risk tolerance. Investors must consider their investment objectives and how cryptocurrency aligns with these goals.

Defining Investment Goals with Cryptocurrency

Cryptocurrency can be used to achieve various investment goals, such as growth, income, diversification, or speculation. Understanding these goals is crucial in determining whether crypto is a suitable investment. For instance, if an investor is seeking long-term growth, they may consider allocating a portion of their portfolio to cryptocurrency.

Investment Goals and Cryptocurrency

| Investment Goal | Cryptocurrency’s Role |

|---|---|

| Growth | Potential for long-term appreciation |

| Income | Limited income-generating potential |

| Diversification | Low correlation with traditional assets |

| Speculation | High volatility presents opportunities |

Comparing Crypto to Traditional Asset Classes

Cryptocurrency’s risk-return profile differs significantly from traditional asset classes like stocks, bonds, and commodities. While it offers the potential for high returns, it also comes with high volatility and risk. Investors should consider their risk tolerance and investment horizon when deciding whether to invest in crypto.

As cryptocurrency continues to evolve, its correlation with traditional markets is being closely monitored. Some studies suggest that crypto assets have a low correlation with traditional assets, making them a potential diversification tool. However, this is still a developing area of research.

“The cryptocurrency market is still in its early stages, and its potential for growth is substantial. However, investors must be cautious and well-informed.”

Ultimately, whether crypto is a good investment depends on individual circumstances. By understanding investment goals, risk tolerance, and the unique characteristics of cryptocurrency, investors can make informed decisions about including crypto in their portfolios.

The Potential Rewards of Cryptocurrency Investing

The potential rewards of cryptocurrency investing are multifaceted, including high returns and portfolio diversification. As investors explore the digital economy, understanding these benefits is crucial for making informed decisions.

Growth Potential and Historical Returns

Cryptocurrencies have demonstrated significant growth potential, with some experiencing substantial returns in the past. For instance, early adopters of Bitcoin have seen considerable gains. However, it’s essential to note that past performance is not indicative of future results. The historical growth trajectory of major cryptocurrencies and their potential for future appreciation are key factors to consider.

Portfolio Diversification Benefits

Cryptocurrency’s low correlation with traditional assets can enhance portfolio diversification. By adding cryptocurrency to a traditional portfolio, investors may improve risk-adjusted returns. This diversification benefit is particularly appealing in times of market volatility.

Accessibility and Financial Inclusion

Cryptocurrency offers unparalleled accessibility to financial services, enabling participation from anyone with an internet connection. This aspect is particularly significant for the unbanked or underbanked populations worldwide, providing them with an opportunity to engage in the global economy.

Major Risk Factors in the Crypto Market

Cryptocurrency investments are associated with several major risk factors that investors must consider. The crypto market is known for its unpredictability, and understanding these risks is crucial for making informed investment decisions.

Price Volatility and Market Uncertainty

The highly volatile nature of cryptocurrency price fluctuations can result in significant financial losses if not managed properly. Historical data shows that market corrections have had a substantial impact on investor portfolios. Factors such as speculation and market manipulation contribute to this uncertainty.

Security Concerns and Theft Risks

Security is a major concern in the crypto space, with numerous incidents of theft and fraud reported. Investors must be aware of the risks associated with storing and trading cryptocurrencies, and take appropriate measures to secure their assets.

Regulatory and Legal Challenges

The regulatory landscape for cryptocurrencies is evolving and varies across jurisdictions. This creates compliance challenges for investors and can impact the risk profile of crypto investments. As

“the regulatory environment continues to shift, it is essential for investors to stay informed about potential changes that could affect their investments.”

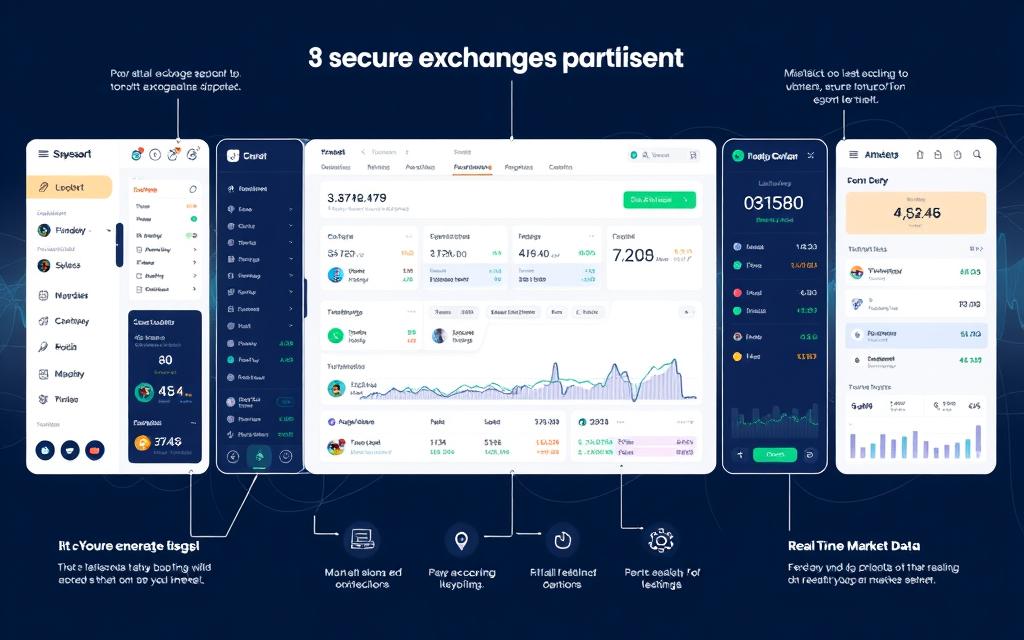

Cryptocurrency Investment Vehicles

The rise of cryptocurrency has led to the development of diverse investment vehicles, catering to different investor needs and risk tolerances. Investors can now choose from a range of options to gain exposure to the crypto market.

Direct Cryptocurrency Purchases

Investors can buy cryptocurrencies directly through exchanges. This method requires careful consideration of wallet selection and security measures to protect digital assets.

Spot Bitcoin ETFs and Their Impact

Spot Bitcoin ETFs offer a regulated way for traditional investors to engage with cryptocurrency. Unlike futures-based ETFs, spot Bitcoin ETFs track the actual price of Bitcoin, potentially reducing the risk of underperformance.

Other Crypto-Related Investment Products

Other investment products include crypto mining stocks, blockchain ETFs, and cryptocurrency trusts. These options provide varied risk-return profiles, allowing investors to diversify their portfolios.

Investment Strategies for the Crypto Market

Effective investment strategies are crucial for navigating the volatile cryptocurrency market. Investors need to be well-informed and adaptable to succeed in this rapidly evolving landscape.

Dollar-Cost Averaging in Cryptocurrency

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This strategy helps reduce the impact of short-term volatility by spreading out the investment over time. For example, an investor might invest $100 in Bitcoin every month, regardless of its price, to average out the cost over time.

Time in the Market vs. Timing the Market

Two contrasting strategies in crypto investing are “time in the market” and “timing the market.” The former involves holding investments for an extended period to capitalize on long-term growth, while the latter attempts to predict market movements to buy low and sell high. Historical data shows that timing the market is challenging, even for experienced investors.

Building a Balanced Crypto Portfolio

A balanced crypto portfolio is essential for managing risk. This involves diversifying investments across different blockchain ecosystems and allocating assets between established cryptocurrencies and emerging projects. Regular portfolio rebalancing is also crucial to maintain an optimal asset allocation in the rapidly evolving crypto market.

Security Best Practices for Crypto Investors

The security of cryptocurrency investments is a critical concern that demands attention to best practices. As the crypto market continues to evolve, investors must stay informed about the best ways to protect their digital assets.

Choosing Reputable Exchanges

When selecting a cryptocurrency exchange, it’s crucial to evaluate its security measures, insurance policies, and regulatory compliance. Look for exchanges that have a strong track record of security and transparency.

Cold Storage and Wallet Security

Cold storage solutions, such as hardware wallets, offer an additional layer of security for significant cryptocurrency holdings. Compare different types of wallets to determine which best suits your needs.

Protecting Your Digital Assets

To safeguard your crypto investments, implement best practices such as multi-signature authentication, regular security audits, and secure private key management.

Tax Implications of Cryptocurrency Investments

Understanding the tax implications of cryptocurrency investments is crucial for compliance and financial planning. The IRS has established that cryptocurrencies are treated as property, not currency, which has significant implications for tax purposes.

IRS Treatment of Crypto Assets

The IRS considers cryptocurrency transactions as taxable events. This means that selling, trading, or using cryptocurrencies for purchases can trigger tax liabilities. Because cryptocurrencies are viewed as property, they are subject to capital gains and losses tax rules, similar to other assets.

Reporting Requirements and Strategies

Accurate reporting of cryptocurrency transactions is essential. Investors must document all transactions to properly report gains and losses on their tax returns. Tax-efficient strategies, such as holding periods and loss harvesting, can help minimize tax liabilities. It’s also important to be aware of the potential consequences of non-compliance and to consult with tax professionals familiar with cryptocurrency taxation.

Current Market Trends Shaping Crypto’s Future

As we navigate the ever-changing landscape of cryptocurrency, several key trends are coming to the forefront. The cryptocurrency market is being influenced by various factors, including institutional adoption and regulatory developments.

Institutional Adoption and Its Effects

The surge in institutional adoption of cryptocurrencies is a significant trend. Mainstream financial institutions and businesses are now offering and accepting cryptocurrencies, lending legitimacy to the market. For instance, Donald Trump’s recent victory in the U.S. presidential election has electrified the crypto market, propelling Bitcoin to a record high.

Regulatory Developments to Watch

Regulatory developments are also playing a crucial role in shaping the future of cryptocurrency. The potential for a more crypto-friendly administration, coupled with announcements like Trump’s plan to buy and hold Bitcoin in the U.S. treasury, is influencing market sentiment. Evolving global regulatory frameworks will continue to impact the cryptocurrency market, creating both challenges and opportunities for investors.

Evaluating Crypto’s Long-Term Potential

As the cryptocurrency market continues to evolve, assessing its long-term potential involves examining its functionality as both a medium of exchange and an investment vehicle. The dual nature of cryptocurrency raises important questions about its future viability.

Cryptocurrency as a Currency vs. Investment Asset

Cryptocurrency’s role as a currency is hindered by factors such as price volatility and high transaction fees. According to Schwab, the introduction of bitcoin ETFs may not significantly alter these barriers. As such, cryptocurrency’s effectiveness as a medium of exchange, unit of account, or store of value remains limited.

Future Use Cases and Technological Advancements

Despite current limitations, ongoing technological advancements are poised to enhance cryptocurrency’s utility. Developments such as layer-2 scaling solutions, interoperability, and energy efficiency improvements could drive long-term value. The table below highlights key technological advancements and their potential impacts.

| Technological Advancement | Potential Impact |

|---|---|

| Layer-2 Scaling Solutions | Enhanced transaction capacity and reduced fees |

| Interoperability | Increased compatibility across different blockchain networks |

| Energy Efficiency Improvements | Reduced environmental impact and increased sustainability |

By addressing current limitations, these advancements could bolster cryptocurrency’s position in the future global financial system.

Common Mistakes New Crypto Investors Make

New cryptocurrency investors often fall into common pitfalls that can be avoided with proper knowledge and caution. The crypto market’s volatility and complexity can lead to costly mistakes if not navigated carefully.

Emotional Decision-Making and FOMO

One of the most significant mistakes new investors make is allowing emotional decision-making to guide their investment choices. The fear of missing out (FOMO) can lead to impulsive decisions, often resulting in buying at peaks and selling at troughs. To avoid this, it’s crucial to maintain a disciplined approach and not let emotions dictate investment decisions.

Lack of Research and Due Diligence

Another critical mistake is failing to conduct thorough research and due diligence before investing in a cryptocurrency. It’s essential to evaluate the project’s team, technology, use case, and tokenomics rather than relying solely on price action or social media hype. For guidance on how to properly research and invest in crypto, check out this step-by-step guide on how to buy crypto in 2025.

Improper Risk Management

Risk management is crucial in the volatile crypto market. New investors often fail to properly manage their risk, leading to overexposure and significant losses. Techniques such as position sizing and setting stop-loss levels can help mitigate potential losses and protect investments.

Who Should Consider Investing in Cryptocurrency

The decision to invest in cryptocurrency should be based on a comprehensive understanding of the risks involved and one’s overall investment portfolio. Cryptocurrency investing is a high-risk, high-reward endeavor that may not be suitable for all investors.

Risk Tolerance Assessment

Assessing one’s risk tolerance is crucial before investing in cryptocurrency. Investors should consider their ability to withstand significant price volatility and potential losses. A risk tolerance assessment involves evaluating factors such as age, financial stability, and investment goals.

Portfolio Allocation Recommendations

When it comes to portfolio allocation, a common recommendation is to allocate only a small percentage of one’s investment portfolio to cryptocurrency, typically no more than 5%. This approach helps manage risk and ensures that potential losses do not significantly impact overall financial stability.

| Investor Profile | Recommended Crypto Allocation |

|---|---|

| Conservative | 0-2% |

| Moderate | 2-4% |

| Aggressive | 4-6% |

Conclusion: Balancing Opportunity and Risk in Crypto Investing

As cryptocurrency continues to reshape the investment landscape, understanding its potential and pitfalls is crucial for investors. Throughout this article, we’ve explored the key aspects of crypto investing, from its evolution and market dynamics to the risks and rewards associated with it.

The cryptocurrency market offers significant opportunities for growth and diversification, but it also comes with substantial risks. To navigate this complex landscape, investors must approach crypto investing with clear goals, realistic expectations, and a thorough understanding of the market.

By staying informed and adapting to the changing market conditions, investors can make more informed decisions about their investment in cryptocurrencies. Ultimately, a balanced perspective that acknowledges both the potential and the risks of crypto investing is essential for success in this emerging asset class.

FAQ

What is the best way to store my cryptocurrency?

The best way to store your cryptocurrency is by using a reputable cold storage solution, such as a hardware wallet, to protect your digital assets from theft and unauthorized access.

How do I choose a reliable cryptocurrency exchange?

To choose a reliable cryptocurrency exchange, consider factors such as security measures, regulatory compliance, fees, and user reviews to ensure a safe and trustworthy trading experience.

What are the tax implications of investing in cryptocurrency?

The IRS treats cryptocurrency as a capital asset, subject to capital gains tax; investors must report their transactions and pay taxes on their gains, and consult a tax advisor for specific guidance.

How does blockchain technology drive value in cryptocurrency?

Blockchain technology provides a secure, transparent, and decentralized ledger for transactions, which helps to establish trust and drive value in cryptocurrency by ensuring the integrity of the network.

What is dollar-cost averaging in cryptocurrency investing?

Dollar-cost averaging is an investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s performance, to reduce the impact of volatility on your investments.

How do spot Bitcoin ETFs work?

Spot Bitcoin ETFs allow investors to buy and sell Bitcoin on a traditional exchange, providing a more familiar and regulated investment vehicle for those looking to gain exposure to the cryptocurrency market.

What are the benefits of diversifying my portfolio with cryptocurrency?

Diversifying your portfolio with cryptocurrency can provide a potential hedge against traditional assets, as well as opportunities for growth and returns that are not correlated with other investments.

How do I assess my risk tolerance for cryptocurrency investing?

To assess your risk tolerance, consider your financial goals, investment horizon, and comfort level with market volatility, and adjust your investment strategy accordingly to ensure that you’re not taking on too much risk.

What are some common mistakes new crypto investors make?

New crypto investors often make emotional decisions based on FOMO, fail to conduct proper research, and neglect to implement risk management strategies, which can lead to significant losses.

How do regulatory developments impact the cryptocurrency market?

Regulatory developments can significantly impact the cryptocurrency market, as clear and favorable regulations can increase adoption and investment, while unclear or restrictive regulations can create uncertainty and volatility.