Crypto Investing for Beginners: From First Dollar to Portfolio Strategy

Entering the world of crypto can be daunting for newcomers. As digital assets continue to capture the attention of both individual and institutional investors, understanding the basics of cryptocurrency is crucial.

The crypto market operates differently than traditional investment markets, presenting unique risks and opportunities. As a beginner, navigating this landscape requires a solid grasp of the fundamentals and a clear understanding of the potential risks involved.

This guide aims to equip you with the knowledge to make informed decisions about cryptocurrency investing, regardless of your starting capital or investment goals, and to help you understand the role of digital assets within the broader financial ecosystem.

Understanding Cryptocurrency Fundamentals

Understanding the basics of cryptocurrency is essential for navigating the modern financial world. Cryptocurrencies are digital assets that utilize blockchain technology to facilitate secure, decentralized transactions.

What Is Cryptocurrency and How Does It Work?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and is decentralized, meaning it’s not controlled by any government or financial institution. The underlying technology behind cryptocurrency is blockchain, a distributed ledger that records all transactions made with a particular cryptocurrency. As

“Blockchain technology has the potential to disrupt traditional financial systems by providing a secure, transparent, and efficient way to conduct transactions.”

Transactions are verified by nodes on the network through complex algorithms and cryptography, ensuring the integrity of the transaction and the network.

The Difference Between Crypto and Traditional Assets

The key difference between cryptocurrency and traditional assets, such as stocks and bonds, lies in their inherent characteristics. Unlike traditional assets, cryptocurrencies are not tied to any particular company or government, and their value is determined solely by market forces. As a result, the crypto market is known for its volatility, with prices fluctuating rapidly. Furthermore, the decentralized nature of cryptocurrencies means that they are not subject to the same regulatory frameworks as traditional assets, offering a unique investment opportunity.

Cryptocurrencies also offer practical utility, such as the ability to exchange them for goods and services. For instance, Bitcoin is often viewed as a store of value, while Ethereum’s smart contract functionality enables a wide range of decentralized applications.

How to Invest in Crypto: Three Main Approaches

The crypto market offers various investment approaches, catering to different investor needs. Investors can gain exposure to cryptocurrency through multiple methods, each with its advantages and considerations.

Buying Cryptocurrency Directly

Investing directly in cryptocurrency is the most straightforward method. This involves purchasing coins through a reputable crypto exchange or brokerage platform. Investors have full control over their assets and can store them in digital wallets. However, this method requires a good understanding of security measures to protect against potential threats.

Direct investment in crypto allows for 24/7 trading and the ability to participate in the growing ecosystem of decentralized finance (DeFi). Investors can choose from a wide range of cryptocurrencies, including Bitcoin and other altcoins.

Investing in Crypto ETPs and ETFs

Crypto Exchange-Traded Products (ETPs) and Exchange-Traded Funds (ETFs) offer an alternative way to invest in cryptocurrency without directly owning the assets. These financial products track the price of one or more cryptocurrencies, providing exposure to the market through traditional investment channels.

ETPs and ETFs are traded on conventional stock exchanges, making them more accessible to investors familiar with traditional markets. They offer a layer of regulatory oversight and can simplify the investment process.

| Investment Method | Accessibility | Security Requirements |

|---|---|---|

| Direct Crypto Purchase | High | High |

| Crypto ETPs/ETFs | Medium | Low |

| Crypto-Related Stocks | High | Medium |

Purchasing Crypto-Related Stocks

Investing in companies related to the crypto industry is another viable option. This includes exchanges like Coinbase, Bitcoin mining companies, and traditional businesses with significant blockchain investments. By investing in these stocks, investors can gain exposure to the crypto market through the stock market.

This method allows investors to leverage their existing knowledge of stock market investing while still benefiting from the growth of the crypto industry.

Getting Started: Setting Up Your First Crypto Investment

Setting up your first crypto investment is a crucial step in your digital asset journey. To begin, you need to understand the process of choosing a platform, creating an account, and making your first purchase.

Choosing a Reputable Platform or Exchange

Selecting a reputable cryptocurrency exchange or investment platform is the foundation of your crypto investment journey. When choosing a platform, consider factors such as reputation, security features, available cryptocurrencies, fees, and user experience. Look for platforms that have a strong track record, robust security measures like two-factor authentication, and a user-friendly interface. Some popular options include Coinbase, Binance, and Kraken.

Creating and Securing Your Crypto Account

Once you’ve chosen a platform, the next step is to create and secure your crypto account. This involves completing the Know Your Customer (KYC) process, which typically requires identification documents to comply with regulatory requirements. After setting up your account, enable two-factor authentication (2FA) and use a strong, unique password to protect your account. It’s also advisable to use a hardware wallet for added security.

- Complete the KYC process with required documents.

- Enable 2FA for an extra layer of security.

- Use a strong and unique password.

Making Your First Purchase

With your account set up and secured, you’re ready to make your first purchase. Decide on the cryptocurrency you want to buy and choose between a market order and a limit order. Understand the transaction fees and confirmation times associated with your purchase. After buying, consider transferring your crypto to a secure wallet and monitor your investment.

- Choose the cryptocurrency you wish to purchase.

- Decide on the type of order (market or limit).

- Review transaction fees and confirmation times.

Understanding Crypto Investment Risks

Before diving into crypto investing, it’s crucial to comprehend the risks involved, such as price fluctuations and security vulnerabilities. Cryptocurrency investments are known for their high-risk nature, and understanding these risks is vital for making informed decisions.

Market Volatility and Price Fluctuations

The cryptocurrency market is highly volatile, with prices capable of fluctuating significantly within a short period. This volatility can be attributed to various factors, including market demand, regulatory changes, and global economic conditions. Investors should be prepared for the possibility of substantial price swings.

Regulatory Uncertainties

The regulatory environment for cryptocurrencies is still evolving and varies globally. Regulatory uncertainties can significantly impact cryptocurrency valuations and accessibility. Investors must stay informed about regulatory changes that could affect their investments.

Security Vulnerabilities

Cryptocurrency investments are susceptible to various security vulnerabilities, including exchange hacks and phishing attacks. Investors must take necessary precautions to secure their digital assets, such as using reputable exchanges and enabling two-factor authentication.

Lack of Insurance Protection

Unlike traditional bank deposits, cryptocurrencies are not insured by the Federal Deposit Insurance Corporation (FDIC) or the Securities Investor Protection Corporation (SIPC). This lack of insurance protection means that investors could lose their entire investment if the exchange or wallet is compromised.

In conclusion, understanding the risks associated with cryptocurrency investments is crucial for beginners. By being aware of market volatility, regulatory uncertainties, security vulnerabilities, and the lack of insurance protection, investors can make more informed decisions and potentially mitigate some of these risks.

Essential Security Practices for Crypto Investors

In the realm of cryptocurrency, security is not just a feature, but a necessity for safeguarding your investments. As the crypto space continues to evolve, investors must stay vigilant against potential threats to their digital assets.

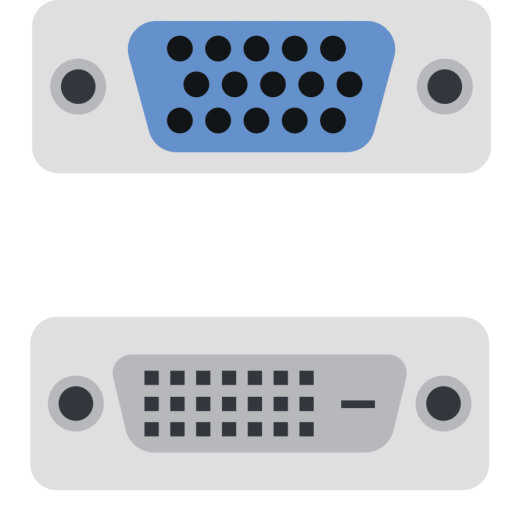

Wallet Types and Security Features

Cryptocurrency wallets come in various forms, each with its own security advantages and limitations. Hardware wallets offer offline storage, providing robust protection against online threats. Software wallets, while more convenient, are more vulnerable to hacking attempts. Understanding these differences is crucial for selecting the right wallet for your needs.

| Wallet Type | Security Features |

|---|---|

| Hardware Wallet | Offline storage, robust protection against online threats |

| Software Wallet | Convenient, but vulnerable to hacking attempts |

| Mobile Wallet | Easy to use, but susceptible to malware and phishing attacks |

Best Practices for Protecting Your Digital Assets

To safeguard your cryptocurrency, it’s essential to implement robust security measures. Enable multi-factor authentication and use hardware security keys to add layers of protection. Regularly update your passwords and be cautious of phishing attempts and fake apps.

Recovery Options and Backup Strategies

Having a reliable backup and recovery plan is vital. Store your private keys and seed phrases securely and redundantly. Regularly test your recovery procedures to ensure you can regain access to your assets in case of an emergency.

By adopting these essential security practices, crypto investors can significantly reduce the risk of theft and accidental loss, ensuring their digital assets remain protected.

Building a Diversified Crypto Portfolio

Diversification is key to a successful crypto investment strategy, allowing investors to spread risk across various assets. A diversified portfolio can help mitigate potential losses and maximize returns in the volatile cryptocurrency market.

Asset Allocation Strategies for Beginners

For beginners, a conservative asset allocation strategy may involve a higher weighting towards established cryptocurrencies like Bitcoin. This approach can provide a foundation for the portfolio while reducing exposure to more volatile assets. Investors can also consider allocating a portion of their portfolio to ETPs (Exchange-Traded Products) or ETFs (Exchange-Traded Funds) that track the broader crypto industry, offering a more diversified exposure.

- Start with a core holding in established cryptocurrencies.

- Allocate a smaller portion to higher-risk, higher-reward assets.

- Consider using ETPs or ETFs for diversified exposure.

Balancing High-Risk and Established Cryptocurrencies

Balancing high-risk and established cryptocurrencies is crucial for managing risk. Established cryptocurrencies like Bitcoin and Ethereum can provide stability, while newer or smaller market cap assets can offer higher potential returns. Investors should evaluate their risk tolerance and investment goals when deciding on the allocation between these categories.

Incorporating Crypto into Your Broader Investment Strategy

When incorporating crypto into a broader investment strategy, it’s essential to consider the correlation between cryptocurrencies and traditional assets. Investors may allocate a specific percentage of their overall portfolio to crypto, depending on their risk tolerance and investment objectives. Diversified investment vehicles like crypto-related stocks or funds can also be considered.

- Evaluate the correlation between crypto and traditional assets.

- Determine an appropriate allocation percentage for crypto.

- Consider diversified investment vehicles for crypto exposure.

Tax Implications of Cryptocurrency Investing

Understanding the tax implications of cryptocurrency investing is crucial for investors to comply with IRS regulations. The IRS treats cryptocurrencies as property, not currency, which has significant implications for tax purposes.

Reporting Crypto Transactions

Cryptocurrency investors must report all transactions involving cryptocurrencies, including sales, trades, and purchases. The IRS requires detailed records of these transactions, including the date acquired, the cost basis, and the sale proceeds. Investors can use specialized crypto tax software or consult with a tax professional to ensure accurate reporting.

Strategies for Tax-Efficient Crypto Investing

Investors can employ several strategies to minimize their tax liability when investing in cryptocurrencies. One approach is to hold investments for more than a year to qualify for long-term capital gains treatment, which typically results in a lower tax rate. Another strategy is to utilize tax-advantaged accounts, such as IRAs, for cryptocurrency investments. As the market evolves, more financial services companies may offer the option to hold crypto in retirement accounts, potentially enhancing portfolio returns and diversification.

Conclusion: Navigating Your Crypto Investment Journey

As we conclude this guide, it’s essential to reflect on the key takeaways for navigating the complex world of cryptocurrency investing. The crypto market is known for its highly volatile nature, making risk management a top priority. Investors should only allocate funds they can afford to lose entirely, avoiding financial stress.

To succeed in this space, it’s crucial to stay informed about market trends, technological developments, and regulatory changes. Consider diversifying your portfolio by investing in various cryptocurrencies and exploring ETPs (Exchange-Traded Products). Establishing clear investment goals and time horizons will also help guide your decisions.

As you continue your crypto investment journey, remember to evaluate your success beyond simple price appreciation. Consider your portfolio’s performance relative to benchmarks and risk-adjusted returns. By doing so, you’ll be better equipped to navigate the market fluctuations and make informed decisions about your assets.

Ultimately, a well-informed and cautious approach will serve you well in the crypto market. Stay vigilant, and you’ll be poised to capitalize on the opportunities that this dynamic industry has to offer.

FAQ

What is the difference between spot crypto and other investment products?

Spot crypto refers to the purchase or sale of a digital asset for immediate delivery, as opposed to futures or options contracts. This means that when you buy spot crypto, you are purchasing the actual cryptocurrency, rather than a derivative product.

Are my crypto investments insured by the Federal Deposit Insurance Corporation (FDIC)?

No, cryptocurrency investments are not insured by the FDIC. The FDIC provides insurance coverage for deposits in financial services institutions, such as banks and thrifts, but it does not cover investments in digital assets or other non-deposit products.

What are the risks associated with investing in cryptocurrencies?

Investing in cryptocurrencies is considered highly volatile and subject to significant price fluctuations. Additionally, cryptocurrency markets are still relatively unregulated, which can increase the risk of security vulnerabilities and other potential issues.

How can I protect my digital assets from theft or loss?

To protect your digital assets, it is essential to use a reputable wallet with robust security features, such as multi-factor authentication and encryption. You should also implement best practices, such as keeping your wallet software up to date and using strong passwords.

What are the tax implications of investing in cryptocurrencies?

The tax implications of investing in cryptocurrencies can be complex and depend on various factors, including your tax status and the specific cryptocurrencies you are investing in. It is recommended that you consult with a tax professional to understand your obligations and develop a tax-efficient investment strategy.

Can I use cryptocurrency ETPs or ETFs to gain exposure to digital assets?

Yes, cryptocurrency ETPs and ETFs can provide a convenient way to gain exposure to digital assets without directly holding them. These products are traded on traditional stock exchanges and can offer a more familiar investment experience for some investors.

What is the role of blockchain in cryptocurrency investing?

Blockchain is the underlying technology that enables the creation, trading, and ownership of digital assets. It provides a secure, decentralized, and transparent record of transactions, which is essential for the functioning of cryptocurrency markets.