Crypto Wallets Made Easy: How to Store Your Coins Safely

In the evolving blockchain landscape, crypto wallets are essential for securely storing and managing digital assets. These wallets come in two primary forms: hot wallets, which are connected to the internet and available as software or web-based apps, and cold wallets, which are offline storage solutions often in the form of physical devices.

Understanding the fundamentals of wallet technology is crucial for protecting investments from potential security threats. For those new to the world of cryptocurrency, setting up a crypto wallet can seem daunting, but it’s a critical step. To learn more about navigating the crypto ecosystem, you can visit our guide on how to buy crypto in 2025. By grasping key concepts such as private keys and public addresses, users can confidently store their cryptocurrency assets.

Understanding Crypto Wallets and Why You Need One

Understanding crypto wallets is crucial for navigating the world of cryptocurrency. A crypto wallet is not just a container for your digital assets; it’s a critical tool that enables you to interact with blockchain networks. Crypto wallets come in various forms, including software applications, hardware devices, and even paper documents, each with its own set of security features and use cases.

What Is a Crypto Wallet?

A crypto wallet is essentially a software program that stores your private and public keys, allowing you to send and receive cryptocurrency. The public key is akin to a bank account number that you can share with others to receive crypto, while the private key is used to sign transactions, enabling you to send crypto. It’s crucial to keep your private keys secure as they grant access to your digital assets.

- A crypto wallet generates and stores cryptographic keys.

- Public keys create wallet addresses for receiving crypto.

- Crypto wallets provide an interface to view balances and initiate transactions.

How Crypto Wallets Work

When you make a transaction, your wallet creates a digital signature using your private key, confirming your ownership and authorizing the transfer without revealing the key itself. This process is fundamental to how crypto wallets work, ensuring secure and decentralized transactions. For more information on using cryptocurrency for transactions, you can refer to a beginner’s guide to paying with.

| Wallet Type | Security Features | Use Cases |

|---|---|---|

| Hot Wallets | Connected to the internet, convenient for frequent transactions | Ideal for active traders and everyday transactions |

| Cold Wallets | Offline storage, highly secure against hacking | Suitable for long-term storage of large amounts of cryptocurrency |

Hot vs. Cold Wallets: Key Differences Explained

Understanding the differences between hot and cold wallets is essential for any cryptocurrency investor. The primary distinction lies in their connection to the internet and the level of security they offer.

Hot Wallets: Online and Convenient

Hot wallets are digital tools that remain connected to the internet, allowing users to access and manage their cryptocurrency via their phones, desktops, or web browsers. This constant connection to the connected internet makes them convenient for frequent trading. Examples include mobile applications, desktop software, and web-based platforms.

Hot wallets store public and private keys within the app or website, enabling users to access their funds from anywhere. However, this convenience comes with a higher risk of online security threats and hacking attempts.

Cold Wallets: Offline and Secure

In contrast, cold wallets are designed to be secure by storing private keys offline, either on hardware devices like USB drives or in physical forms such as paper or engraved metal. This “air gap” significantly reduces the risk of remote attacks. Hardware wallets like Ledger and Trezor are popular cold storage solutions that keep private keys secured.

The primary advantage of cold wallets is that they protect against malware, phishing attacks, and exchange breaches by never exposing private keys to an internet-connected device. Many investors use a hybrid approach, keeping small amounts in hot wallets for transactions while storing the majority in cold wallets for maximum security.

How to Get a Crypto Wallet: A Step-by-Step Guide

Acquiring a crypto wallet is a crucial step in your cryptocurrency journey, offering a secure way to store your digital assets. To get started, you need to understand your specific requirements and choose the right type of wallet.

Determining Your Wallet Needs

Before selecting a crypto wallet, assess your specific needs by considering factors like trading frequency, asset types you plan to hold, security requirements, and your technical expertise level. For instance, if you’re a beginner or make frequent transactions, you may prioritize ease of use and accessibility.

Choosing Between Hot and Cold Storage

Deciding between hot wallets and cold wallets depends on your security needs and how often you plan to trade. Hot wallets, such as mobile or web-based applications, offer convenience and ease of access, making them suitable for frequent transactions. On the other hand, cold wallets, like hardware wallets, provide enhanced security by storing your private keys offline, making them ideal for long-term storage of significant cryptocurrency amounts.

| Wallet Type | Security Level | Accessibility |

|---|---|---|

| Hot Wallet | Medium | High |

| Cold Wallet | High | Low |

Setting Up Your First Wallet

Once you’ve chosen your wallet type, the setup process typically involves downloading the application or initializing your hardware device, creating a new wallet, and securely recording your recovery seed phrase. It’s crucial to store your seed phrase securely offline, as it’s the only way to recover your funds if your device is lost or damaged. For a more detailed guide on setting up a crypto wallet, you can visit Investopedia’s guide on creating a crypto.

To enhance security, enable additional features like PIN codes, biometric authentication, and two-factor authentication during the setup process. Consider starting with a small amount of cryptocurrency to familiarize yourself with the wallet’s interface and transaction process before transferring larger amounts.

Top Software Wallets for Everyday Use

When it comes to managing your cryptocurrency, having the right software wallet can make all the difference. Software wallets provide the most accessible entry point for cryptocurrency newcomers, offering intuitive interfaces and simplified key management while maintaining reasonable security standards.

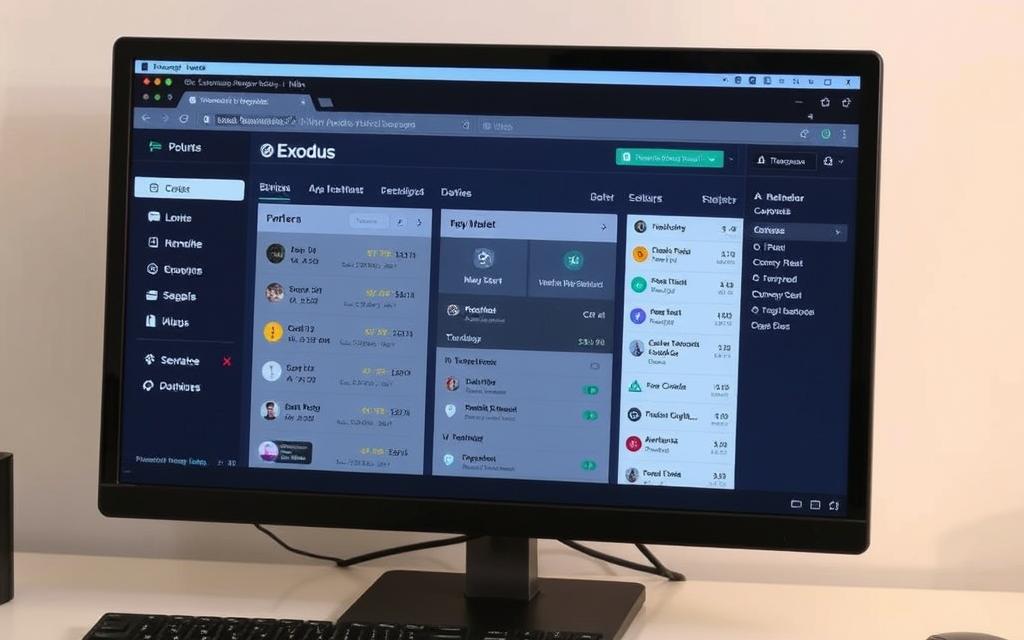

Exodus: Best Overall Software Wallet

Exodus stands out as a comprehensive software wallet solution with support for over 50 blockchain networks, an attractive user interface, and built-in exchange functionality that allows users to swap assets without leaving the application. It’s an excellent option for a variety of investors, particularly those managing diverse portfolios, thanks to its broad asset support and thousands of trading pairs.

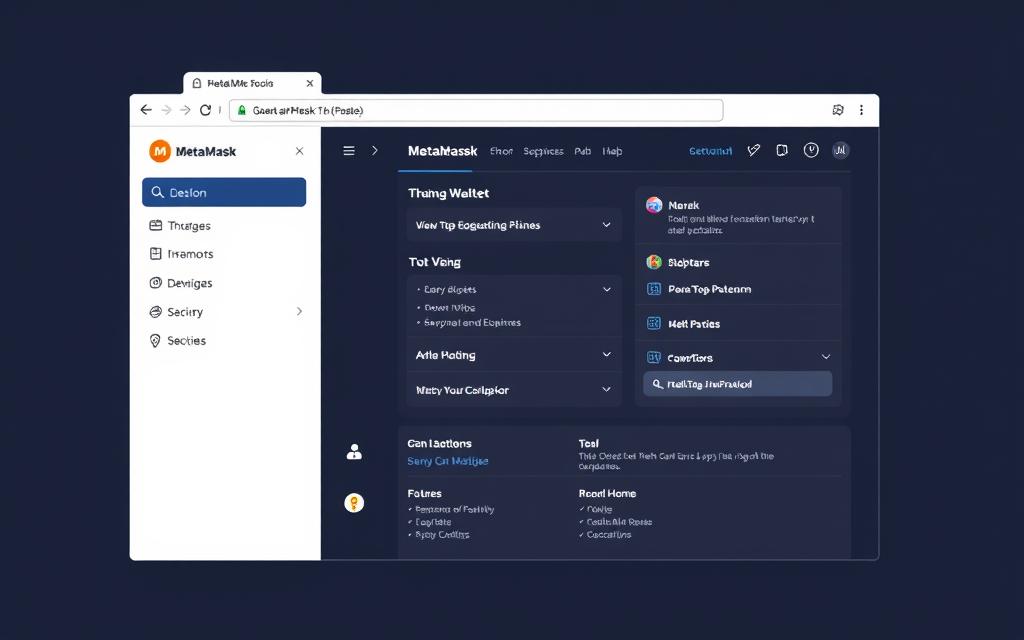

MetaMask: Best for Web3 and DeFi

MetaMask has become the go-to Web3 wallet thanks to its integration with nearly every decentralized finance (DeFi) app and NFT marketplace available today. It combines strong security measures with customizable transaction settings, built-in token tracking, and slippage controls, making it ideal for users interested in DeFi protocols and NFT marketplaces.

Trust Wallet: Best Mobile Experience

Trust Wallet offers one of the best mobile experiences with its clean interface, extensive asset support, and direct integration with decentralized exchanges, making it ideal for on-the-go cryptocurrency management. It boasts extensive support for NFTs and other Web3 projects, receiving high scores on security assessment platforms.

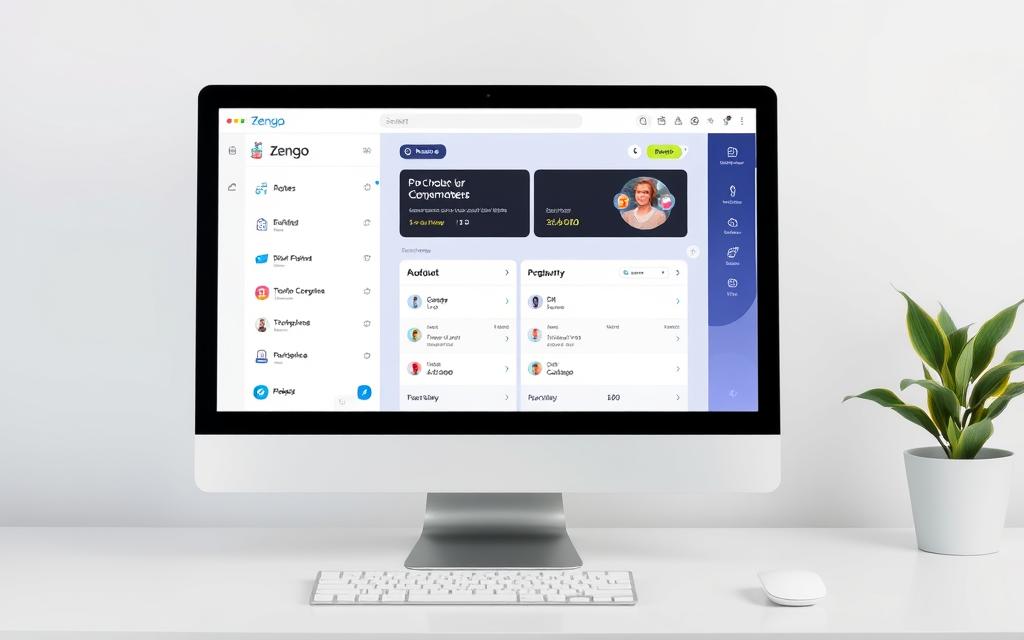

Zengo: Best for Beginners

Zengo revolutionizes the wallet experience by eliminating seed phrases and private keys through its innovative MPC cryptography, providing 24/7 customer support and an exceptionally user-friendly design perfect for beginners. It simplifies the process of managing cryptocurrency, making it accessible to a wider audience.

When evaluating software wallets, consider factors beyond just security, such as supported cryptocurrencies, exchange integration, staking options, and the development team’s reputation and transparency. Most quality software wallets are free to download and use, though they may charge fees for certain transactions or built-in exchange services, making them cost-effective options for new crypto users.

Best Hardware Wallets for Maximum Security

Hardware wallets represent the gold standard in securing your digital assets. These devices are specifically designed to store private keys offline, ensuring that your cryptocurrencies are protected from online threats.

Ledger Nano S Plus: Premium Security Features

The Ledger Nano S Plus is a highly secure hardware wallet that combines affordability with robust security features. It includes a certified secure element chip that provides military-grade protection for your private keys against both physical and virtual attacks. With its compact design and user-friendly interface, it’s an excellent choice for those looking to secure their cryptocurrencies.

Trezor Model One: User-Friendly Hardware Option

Trezor Model One offers an excellent entry point for hardware wallet users. Its open-source design, intuitive interface, and comprehensive security features make it a competitive option at around $49. It’s designed to be user-friendly while maintaining high security standards.

Coldcard: Bitcoin-Focused Security

Coldcard is designed specifically with Bitcoin maximalists in mind. It offers specialized security features such as air-gapped operation, encrypted microSD card support, and anti-tampering measures. These features make it an ideal choice for those looking to secure their Bitcoin holdings.

BitBox02: Compact and Versatile

The BitBox02 stands out with its minimalist design and quick setup process. It features invisible touch sensors that eliminate the need for physical buttons, enhancing its durability. This hardware wallet is both compact and versatile, making it a great option for securing various cryptocurrencies.

All quality hardware wallets, including those mentioned, provide backup and recovery options through seed phrases. This ensures that you can recover your assets even if the physical device is lost, stolen, or damaged. When using hardware wallets, transactions must be physically confirmed on the device itself, creating an additional security layer that prevents remote attackers from transferring funds without physical access.

Specialized Wallets for Specific Needs

For users with specific needs, specialized cryptocurrency wallets offer tailored features that go beyond standard wallet capabilities. These wallets cater to particular requirements, such as enhanced privacy, advanced functionality, or specific cryptocurrency support.

Sparrow: Best for Bitcoin Enthusiasts

Sparrow Wallet provides complete control over Bitcoin transactions, including custom fee settings and UTXO management. It is compatible with all major hardware wallets, enhancing security. The wallet’s transaction editor functions as a blockchain explorer, allowing users to examine transaction details.

BlueWallet: Best Mobile Bitcoin Wallet

BlueWallet excels as a mobile Bitcoin solution with its support for the Lightning Network, enabling near-instant micropayments and reduced transaction fees. It features an intuitive interface and advanced trading features, including batch and partially signed transactions.

Green Wallet: Multi-Signature Security

Green Wallet implements multi-signature security, requiring multiple approvals for transactions and adding a layer of protection against unauthorized access. This feature is particularly beneficial for users seeking enhanced security measures.

These specialized wallets demonstrate the diversity and innovation in the cryptocurrency wallet space, catering to a range of user needs and preferences.

Essential Security Practices for Crypto Storage

The irreversible nature of blockchain transactions makes security a top priority. As the cryptocurrency landscape evolves, implementing robust security practices is crucial for protecting your digital assets.

Protecting Your Private Keys

Never share your private keys or seed phrases with anyone. Store them in a secure, offline environment, such as a hardware wallet or a safe deposit box. Avoid digital storage methods like email or cloud storage, as they are vulnerable to hacking.

Creating Secure Backups

Use a secure method for backing up your recovery phrase, such as engraving it on metal plates. Distribute these backups across multiple secure locations to protect against localized disasters. This ensures that your funds remain accessible even if one backup is compromised.

Avoiding Common Security Pitfalls

Enable all available security features offered by your wallet provider, including PIN codes and two-factor authentication. Be cautious when accessing your cryptocurrency, using only trusted devices and avoiding public Wi-Fi networks. Implement a strategy of wallet segregation by using different wallets for different purposes.

| Security Measure | Description | Benefit |

|---|---|---|

| Hardware Wallets | Store private keys offline | Enhanced security against hacking |

| Seed Phrase Backup | Securely store recovery phrases | Recover funds in case of loss |

| Two-Factor Authentication | Add an extra layer of security | Protect against unauthorized access |

Advanced Features to Look for in Crypto Wallets

Advanced cryptocurrency wallets offer a range of features that go beyond basic storage and transactions, providing integrated tools that enhance functionality and eliminate the need to use multiple applications for different crypto activities. When choosing a crypto wallet, consider the following advanced features to ensure a seamless and secure experience.

Multi-Currency Support

A wallet with multi-currency support allows users to manage diverse cryptocurrency portfolios from a single interface. This feature reduces the complexity of tracking assets across multiple blockchain networks and wallet applications, making it easier to manage crypto holdings.

Built-in Exchange Functionality

Some crypto wallets come with built-in exchange functionality, enabling direct asset swapping within the wallet environment. This feature eliminates the need to transfer funds to external exchanges, thereby reducing both transaction fees and security risks associated with transactions.

Staking and Earning Capabilities

Certain wallets offer staking capabilities, providing opportunities to earn passive income on proof-of-stake cryptocurrencies directly from your wallet. Some solutions also offer automated compounding and reward tracking, enhancing the overall earning potential.

DApp Integration

DApp integration connects your wallet directly to decentralized applications, allowing seamless interaction with DeFi protocols, NFT marketplaces, and other blockchain services without exposing your private keys. For more information on top crypto wallets, you can visit this resource.

Conclusion: Choosing the Right Wallet for Your Crypto Journey

With numerous crypto wallets available, making an informed decision is essential for securing your digital assets. Selecting the right crypto wallet depends on your specific needs, trading habits, and security concerns. For active traders, hot wallets offer convenience, while hardware wallets provide maximum security for long-term holdings. Consider a tiered approach to crypto storage, using multiple wallet types for different purposes. Regardless of your choice, maintaining good security practices, such as managing private keys and updating software, is crucial. This ensures complete control over your funds and a secure cryptocurrency journey.

FAQ

What is the difference between a hot wallet and a cold wallet?

Hot wallets are connected to the internet, making them more convenient for frequent transactions, while cold wallets store private keys offline, providing maximum security for long-term storage.

How do I choose the right wallet for my needs?

Consider your priorities: if you need to make frequent transactions, a hot wallet might be suitable. For long-term storage or maximum security, a cold wallet like a Ledger or Trezor is recommended.

What are the benefits of using a hardware wallet?

Hardware wallets, such as Ledger Nano S Plus or Trezor Model One, offer premium security features, including secure element chips and offline storage, to protect your digital assets.

Can I store multiple cryptocurrencies in one wallet?

Yes, many wallets, including Exodus and Trust Wallet, support multi-currency storage, allowing you to manage various digital assets in one place.

How do I ensure the security of my private keys?

Store your private keys offline, use a reputable wallet with robust security features, and create secure backups to prevent loss or theft.

What is the role of a public key in crypto transactions?

A public key is used to receive cryptocurrency, as it is the address that others can send funds to, while your private key is used to authorize transactions.

Can I buy cryptocurrency directly within a wallet?

Some wallets, such as those integrated with exchanges, allow you to buy cryptocurrency directly within the app, making it convenient to acquire digital assets.

What is the Lightning Network, and how does it relate to crypto wallets?

The Lightning Network is a layer-2 scaling solution for Bitcoin, enabling faster and cheaper transactions. Some wallets, like BlueWallet, support Lightning Network integration.

How do I manage my digital assets across multiple wallets?

Use a wallet with a user-friendly interface, such as Ledger Live, to manage your various digital assets and keep track of your transactions.